- Quickbooks payroll tutorial 2015 how to#

- Quickbooks payroll tutorial 2015 pdf#

- Quickbooks payroll tutorial 2015 pro#

Watch, listen and learn as your expert instructor guides you through each lesson step-by-step.

Quickbooks payroll tutorial 2015 how to#

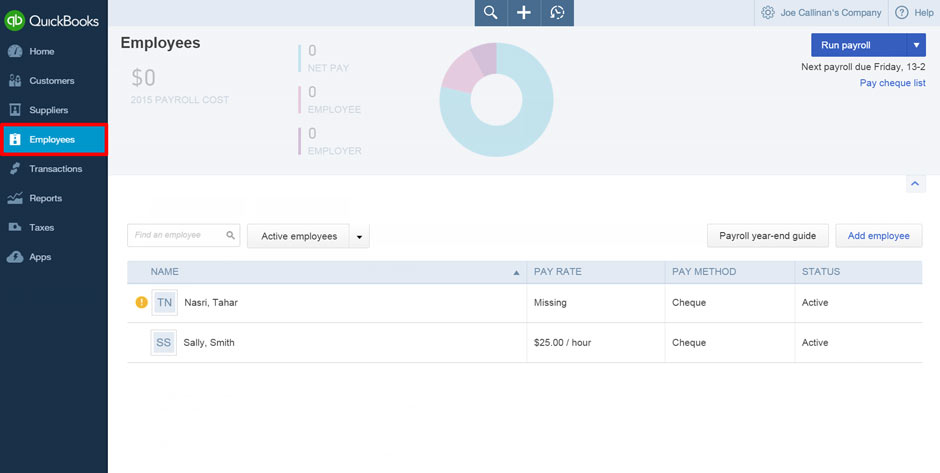

Here are step-by-step instructions on how to use QuickBooks Online. In 1996, Real World Training developed the Mastering QuickBooks seminar. QuickBooks Online Tutorial: A Beginners Guide QuickBooks Online is a great tool to manage your small business accounting with ease. In 1994, the company began focusing exclusively on QuickBooks and began offering training courses on the program. Initially the company provided one-on-one accounting software training to small businesses. Mastering QuickBooks Made Easy features 182 video lessons with over 9 hours of introductory through advanced instruction. Real World Training was founded in 1992 by David J. Once a paycheck has been prepared, you must unlock. Icandothis Terms in this set (10) When you process payroll manually, Quick books automatically prepares your paychecks and files all of your payroll tax reports.

Quickbooks payroll tutorial 2015 pro#

(If you opt for Intuit’s full-service payroll, they do some of this setup for you.) Either way, the Payroll Setup interview keeps track of what you’ve done and what you still have to do. Learn QuickBooks Pro 2015 accounting software with this comprehensive course from TeachUcomp, Inc. Chapter 8 Quickbooks 2015 a complete course.

Quickbooks payroll tutorial 2015 pdf#

quickbooks tutorial pdf format Intuit customers can save 40 on the printed version of QuickBooks 2015: The. It, set up one company file in QuickBooks and use classes. You can walk through each step on your own or use an interview feature built into QuickBooks. quickbooks tutorial pdf 2010 QuickBooks Premier Industry-Specific Editions for Windows. Read honest and unbiased product reviews from our users. Or you can compromise somewhere in the middle.Īfter you choose a payroll service, your next task is to set up everything QuickBooks needs to calculate payroll amounts. Find helpful customer reviews and review ratings for QuickBooks Payroll & Pro 2015, English at. At the other end of the spectrum, you can opt for Intuit’s full-service payroll. To keep expenses low, you can choose a bare-bones service that provides only updated tax tables. If you decide to process payroll in QuickBooks, you should sign up for one of the payroll services that Intuit offers. This is just a summary please click Download Tutorial for detailed instructions with screenshots. Save time with EFILE GST/HST to the CRA2 & more. QuickBooks Pro + Payroll is a complete, easy, cost-effective in-house solution that does not require accounting or payroll experience. When that time comes, you face the daunting task of dealing with payroll, which is the name for all the financial records you have to keep for employees’ salaries, wages, bonuses, withholdings, and deductions. With QuickBooks, business is easier than ever QuickBooks Pro + Payroll 2015 can help you track your finances and get your small business organized.

Unless you run an all-volunteer operation, sooner or later, your employees are going to want to get paid. But if your company is like most, you’ll eventually hire people to help you with all those tasks.

When you first start your business, you may be the proud owner of every job title in your company: receptionist, sales rep, technician, bookkeeper, janitor, and CEO.

0 kommentar(er)

0 kommentar(er)